Australian Taxation Office (ATO) Payment Plan / Payment Arrangement

Where a company is unable to pay its tax debts on time, the Australian Taxation Office (ATO) may permit taxpayers to pay an amount of a tax-related liability by instalments under an arrangement or plan. This provides a company time to catch up with outstanding tax debts by paying smaller amounts over a period while at the same time maintaining ongoing tax liabilities.

FAQ and Case Study

Will my Australian Taxation Office (ATO) payment plan be accepted?

Payment plans will not be accepted as a matter of course. Decisions to grant plans are made in accordance with risk management guidelines PS LA 2011/6:

“Risk assessment is based on objective and subjective facts and logical inference and not on hearsay. A risk assessment must be reasonable, having regard to the circumstances at the time it was made. Historical facts and current data are relevant considerations in this process”

Payment plans are available to individuals and companies.

Some taxpayers will be able to set up automated payment arrangements while others will be required to provide more information to the ATO before the ATO approves the arrangement.

The responsibility to provide relevant information lies with the taxpayer. Accordingly, care needs to be taken to ensure that all relevant information is provided to assist the ATO in approving the arrangement.

How does the automated Australian Taxation Office (ATO) Payment Plan Application Process work?

Businesses can propose a payment plan for debts of less than $100,000 for up to 24 months by using online services for businesses or phoning the ATO automated service number.

The automated service provides a tailored upfront amount based on similar businesses and allows the taxpayer to select payment frequency and instalment values.

While the ATO provides an online payment plan estimator, the automated process puts the obligation on the taxpayer to determine what a sustainable payment plan will be.

Small businesses that owe activity statement amounts of less than $50,000 may be able to apply for an interest-free payment plan to their business in certain circumstances.

We understand that the automated payment plan system uses advanced modelling to predict what type of payment arrangements have been successful in the past comparing similar businesses in similar industries.

Australian Taxation Office (ATO) Payment Plan Application Process debts over $100,000

Businesses with debts over $100,000 are required to phone the ATO on 13 11 42 to discuss their options. The ATO online payment plan estimator may provide some guidance about what amount is acceptable.

ATO may request various information from the taxpayer including:

- The reason for the delay(s) in making the payment; and

- Details about the taxpayer’s financial position including current profit and loss and future cash flow forecasts evidencing profitability and capacity to repay the debt.

- You may consider seeking specialist advice if your tax debt has become unmanageable and may wish for your accountant to negotiate with the ATO regarding any payment plan.

Australian Taxation Office (ATO) considerations when approving payment arrangements

Where the taxpayer is unable to automatically apply for a payment plan, the taxpayer may need to satisfy several ATO considerations before the plan/arrangement is accepted.

Considering some or all the below points as part of any application for a payment arrangement may assist you in having the ATO grant the plan/arrangement:

- Reasons for non-payment – what were the circumstances leading up to this?

- Satisfying the Commissioner as to the taxpayer’s inability to pay the full amount by the due date.

- Detailed statement of the taxpayer’s current financial position including steps taken and arrangements to pay other creditors.

- Show that tax debts are being given the same priority as other debts.

- Detailed proposal for payment in full. This may include cash flow forecasts in certain instances.

- Ability to incorporate additional charges for interest etc.

- Show that the payment can be made by instalments without the total debt escalating.

- The ATO will consider the stage that any legal or recovery action has reached and what alternate collection options there are available. The key takeaway point here is to actively manage the debt as it will become more difficult to argue that a payment arrangement should be granted where there has been a history of non-engagement or non-compliance with the ATO.

- Where the ATO considers that there is a risk to the revenue, the ATO may consider whether that risk could be overcome by seeking some form of security, either over company property, or the director’s personal property. Securities are outlined later in this guide.

- Compliance with other obligations and whether all lodgements are up to date.

Further, the ATO will have regard to the general risk evaluation matters outlined in PS LA 2011/6 summarised previously in this guide. An applicant seeking to have a payment arrangement approved may also consider referring to those matters where it may assist in having the payment arrangement approved.

Australian Taxation Office (ATO) Payment Plan / Arrangement Conditions

- ATO prefers the period for repayment to be the shortest possible timeframe (less than one year) but acknowledges that there may be special circumstances to consider such as the ability to pay, size of the debt, and likely cost of alternate collection activity and may require security to be provided.

When payment arrangements are negotiated, the taxpayer is required to:

- Pay all instalments by their due date; AND

- Require all future tax lodgements to be reported AND PAID on time.

We often see companies unable to continue servicing future tax lodgements and payments on time with directors appearing to only make instalment payments but allowing the overall debt to increase by failing to discharge the entire debt. Directors need to be mindful to continue making and paying all lodgements on time.

- Taxpayer may seek remission of GIC however must demonstrate that remission is warranted – see PS LA 2011/12 for further details.

- The ATO may apply payments towards certain components of tax debts (i.e., PAYG rather than GST) although they are under no obligation to do so.

This is particularly important if any historical debts could be subject to a lockdown Director Penalty Notice (DPN). In those instances, directors should attempt to request the ATO agree that the initial instalment payments be used to primarily pay back the “lockdown” component debt, including SGC. This will eliminate the director’s potential personal exposure.

Can the Australian Taxation Office (ATO) ask for security for tax debts before accepting a payment plan?

Where a company is requesting to make a payment plan to discharge its tax debt, the ATO may, in some instances, request that security be provided before approving any plan.

Requests for security are usually made where the taxpayer is attempting to defer the time of payment or when the taxpayer has a bad compliance history and the ATO insists on security being provided before granting a payment plan.

The security is usually provided by way of a mortgage over real property or an unconditional bank guarantee, either by the taxpayer, i.e., the company, or a third party, usually the company director.

The security request is usually for current debt but may also include an arrangement for future debts arising.

Once security is provided, the ATO will be able to enforce their security in case of non-payment. It is vital that directors carefully consider the solvency of their company and seek appropriate professional advice before providing any securities over their company or personal property. We suggest that directors seek immediate advice on their options should this occur.

Can the Australian Taxation Office (ATO) Termination a payment plan / arrangement?

A payment plan can be terminated if:

- The ATO establishes that information provided by the taxpayer upon which the decision was based was false or misleading.

- Instalments are not paid as required.

- There is a failure to comply with subsequent lodgement and payment obligations.

- Taxpayer’s circumstances change and the Commissioner forms the view that the payment arrangement should be terminated rather than varied.

Can I negotiate a further payment plan / arrangement with the Australian Taxation Office (ATO) after termination?

In our experience, if there are some minor breaches of the payment plan the ATO may allow for the arrangement to be re-negotiated, for example, where payment has inadvertently been made a few days late. However, it is important to always be on the front foot and discuss these matters with the ATO to maintain good faith.

We also regularly see companies entering into multiple payment plans due to several breaches. In those circumstances, we would recommend that the taxpayer consider if they need to address some underlying issues within their business. It may be time to seek restructuring advice to see what other options are available.

Are there any risks when entering into an Australian Taxation Office (ATO) payment plan / arrangement?

There are many risks associated with entering a payment plan. By their very nature, payment arrangements arise due to a company being unable to pay its debts as and when they fall due out of the current firm’s cash flow. A payment arrangement now requires both instalments for historical debt and current ongoing tax obligations to be paid on time. Inadvertently we have seen that in some instances this represents particular risks including that:

- The payment plan is doomed to fail. If there are underlying concerns with the business and cash flow, a payment plan will not address the underlying issues and the debt inevitably escalates further.

- Directors after renegotiating various unachievable payment plans stick their heads in the sand and ignore ATO obligations altogether. Where future lodgements are not reported on time the company debt then becomes personally liable to the director under a lockdown director penalty notice (lockdown DPN).

- If a Liquidator is appointed to a company and recovers payments made under the ATO payment plan as a preference, the ATO may seek indemnity from the director(s) under s588FGA of the Corporations Act with the director(s) being joined in the court proceedings between the ATO and the liquidator. This could result in the director(s) personal assets now being pursued by the ATO.

It is important to carefully consider whether a payment plan will achieve its purpose at all without addressing some of the underlying issues in the business. For example, does the business need to enter some form of protection such as a safe harbour or be restructured through a voluntary administration? Is the better course of action to liquidate the company?

Australian Taxation Office (ATO) payment plan / arrangement case study

- Income tax returns for the company as of June 2016 disclosed carried forward tax losses of around $3.6 Million. As of September 2017, the ATO case notes suggested that the ATO was aware that the company had 17 prior failed payment arrangements and that the company tax accountant advised the ATO that the company “had a loss in 2017 significantly impacting cash flow”. ATO’s tax income profile disclosed the tax group to have below-average economic performance and to be at “higher” risk.

- Nevertheless, the ATO accepted a further payment arrangement for PAYG and GST debt. The company continued to default on the arrangement.

- Company entered Liquidation in March 2018.

- Liquidator claimed an unfair preference for $1.6 Million.

- Following protracted negotiations, the ATO made a final settlement offer of $1.125 Million.

- If the offer was not accepted the ATO advised that it would join the director in any court proceedings and seek indemnity from them under s588FGA of the Corporations Act.

- The major priority creditor was likely to receive 100 cents in the dollar and expressed strong views about funds being available for distribution and not being used to pursue litigation.

- Considering the cost and likely protracted time it would take to litigate, creditors’ consensus was to accept the ATO offer with creditors not prepared to fund any litigation.

- Had the matter proceeded to a hearing the director would likely have been personally liable under the indemnity to repay any judgment amount to the ATO which would have been equivalent to the PAYG component of the debt recovered.

Does the Australian Taxation Office (ATO) allow me to seek a deferral of Payment rather than entering into an ongoing arrangement?

Where there are factors beyond the control of the taxpayer a deferral may be sought in very limited circumstances (PS LA 2011/14) such as:

- Natural disasters (flood, fire, drought, earthquake, and the like)

- Other disasters that may have, or have had, a significant impact on a debtor or region

- The serious illness of a debtor where there is no other person that can make the payment

- A legal impediment (such as probate not being granted or access to funds being denied by order of a Court)

- The embezzlement of the debtor’s payment by the tax agent, solicitor, or another third party

During the COVID-19 pandemic, the ATO recognised that COVID had a significant impact on tax professionals and their clients and provide various support including:

- requests for flexible payment plans,

- lodgement deferrals for upcoming lodgement dates

- payment-only deferrals for amounts that may be due; and

- possible remission of the general interest charges.

The ATO has since moved to assist businesses in particular industries and is slowly returning to pre-pandemic debt management. In particular, we have seen the ATO no longer offering the prolonged payment arrangements that were available during the pandemic times.

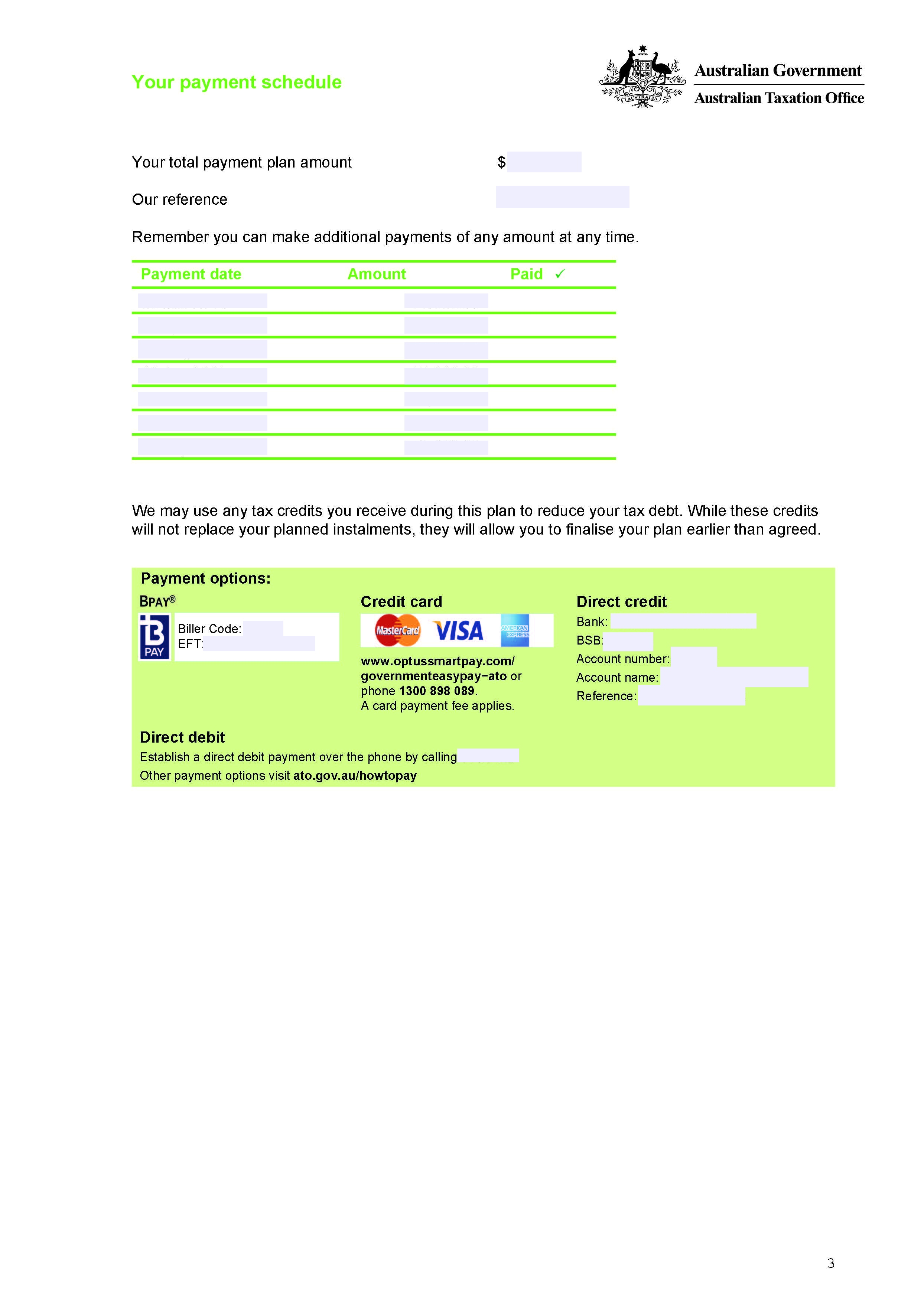

Australian Taxation Office (ATO) Payment Plan Letter of Approval

Once a payment plan is approved the ATO will issue a letter accepting the plan. An example of a payment plan is disclosed below.

|

|

|

Resources

Further Australian Taxation Office (ATO) resources

PS LA 2011/21 - Offsetting of refunds and credits against taxation and other debts -

https://www.ato.gov.au/law/view/document?docid=PSR/PS201121/NAT/ATO/00001

PS LA 2011/18 - Enforcement measures used for collection and recovery of tax-related liabilities -

https://www.ato.gov.au/law/view/document?docid=PSR/PS201118/NAT/ATO/00001

PS LA 2011/17 - Debt relief, waiver and non-pursuit -

https://www.ato.gov.au/law/view/document?docid=PSR/PS201117/NAT/ATO/00001

PS LA 2011/16 - Insolvency - collection, recovery and enforcement issues for entities under external administration -

https://www.ato.gov.au/law/view/document?docid=PSR/PS201116/NAT/ATO/00001

PS LA 2011/14 - General debt collection powers and principles -

https://www.ato.gov.au/law/view/document?docid=PSR/PS201114/NAT/ATO/00001

PS LA 2006/7 - Alternative assessments -

https://www.ato.gov.au/law/view/document?docid=PSR/PS20067/NAT/ATO/00001

PS LA 2011/4 - Collection and recovery of disputed debts -

https://www.ato.gov.au/law/view/document?docid=PSR/PS20114/NAT/ATO/00001

PS LA 2011/3 – Compromise of undisputed tax-related liabilities and other amounts payable to the Commissioner -

https://www.ato.gov.au/law/view/document?docid=PSR/PS20113/NAT/ATO/00001

ATO Website Payment Plans -

https://www.ato.gov.au/General/Paying-the-ATO/Help-with-paying/Payment-plans/

Further Shaw Gidley Articles on Australian Taxation Office (ATO) recovery proceedings

AUSTRALIAN TAXATION OFFICE DIRECTOR PENALTY NOTICE -

https://shawgidley.com.au/blogs/director-penalty-notices

AUSTRALIAN TAXATION OFFICE (ATO) WINDING UP PROCEEDINGS -

https://shawgidley.com.au/blogs/australian-taxation-office-ato-winding-proceedings

AUSTRALIAN TAXATION OFFICE GARNISHEE NOTICES -

https://shawgidley.com.au/blogs/garnishee-notices

AUSTRALIAN TAXATION OFFICE (ATO) CREDIT REPORTING -