From 21 February 2020, the Australian Taxation Office can disclose tax debt information of a business with an ABN to credit reporting bureaus where certain criteria are met.

One of the main purposes of the legislation was to reduce the unfair advantage obtained by businesses that do not pay their tax on time and contribute to more informed decision-making by the business community.

Once the debt is disclosed, a credit search of the ABN will disclose the debt. This will potentially result in various issues to the business including difficulty obtaining finance, stock on credit and current suppliers tightening credit terms.

FAQs

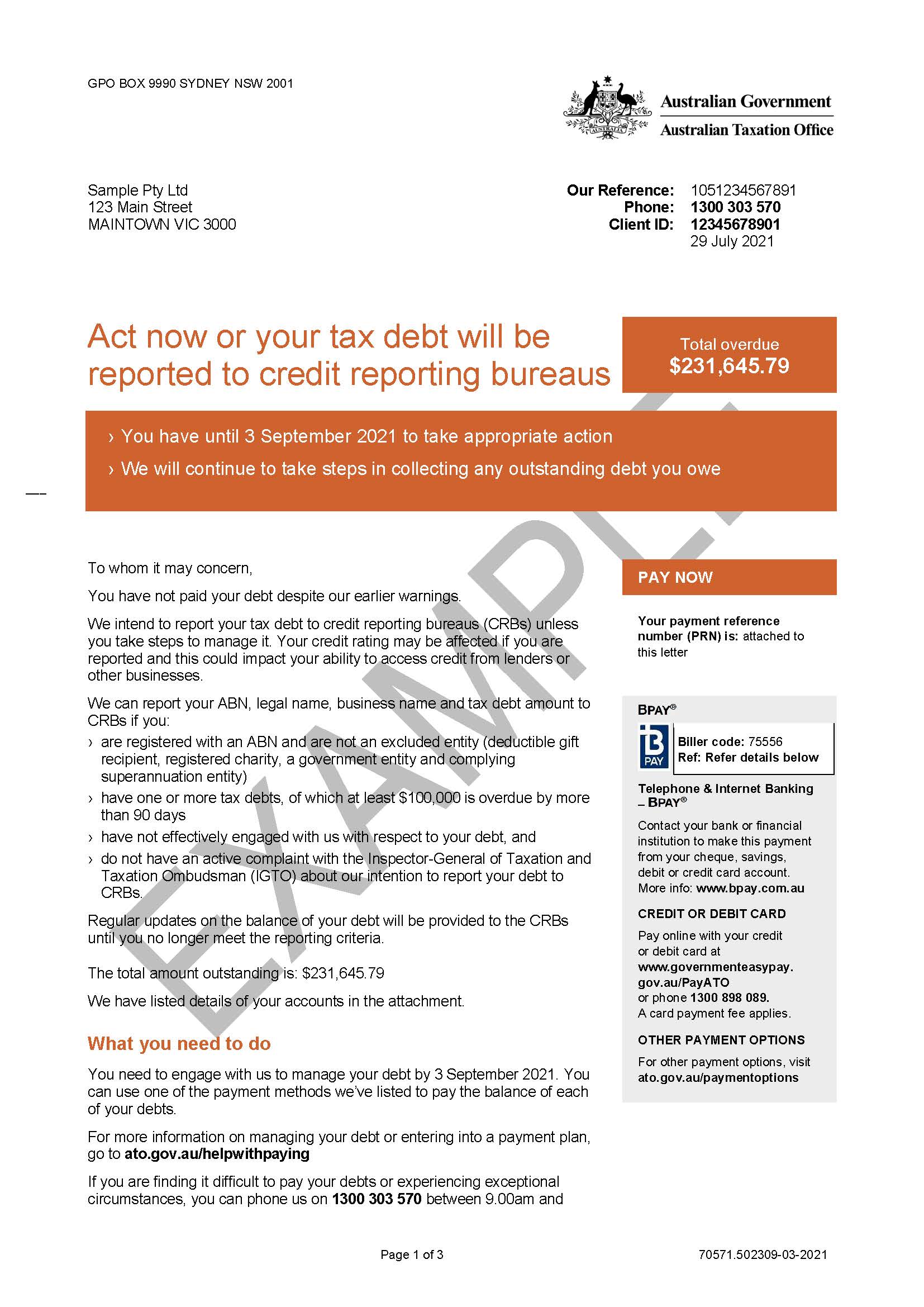

What should I do if I receive a letter from the Australian Taxation Office (ATO) advising that my tax debt will be reported to credit reporting bureaus?

It is important that businesses act fast to address any outstanding tax debts and respond appropriately to the ATO letter. You should immediately make contact with your accountant or a restructuring specialist to discuss your options.

What are some risks of Credit Reporting?

There are various risks associated with the ATO potentially reporting liabilities to credit reporting bureaus:

- One major limitation will be that unreported debts are unknown and that directors to avoid negative credit ratings may cease to report obligations promptly, potentially leading to personal liability for the unreported debts. This could have disastrous consequences for the Director personally and we recommend that these issues be dealt with and not ignored.

- Alternatively, taxpayers will prioritise payment of ATO tax debts above other creditors effectively shifting the debt to trade creditors.

- Reporting may lead to difficulty obtaining finance or engaging with current suppliers who may monitor the accounts receivable more closely / resulting in new suppliers being more cautious when being approached by the company.

- Business owners will be more likely approached / receive “cold calls” by unregulated advisers such as pre-insolvency advisers due to the additional reporting as their credit history will be registered with various CRBs. These advisers are unregulated and may not have the business’s best interests at heart. We recommend business owners always seek advice from qualified professionals such as Shaw Gidley.

- The ATO may commence proceeding with other more aggressive recovery methods once the debt has been reported including issuing garnishee notices, director penalty notices, or even commencing wind-up proceedings against the Company.

Who qualifies for reporting?

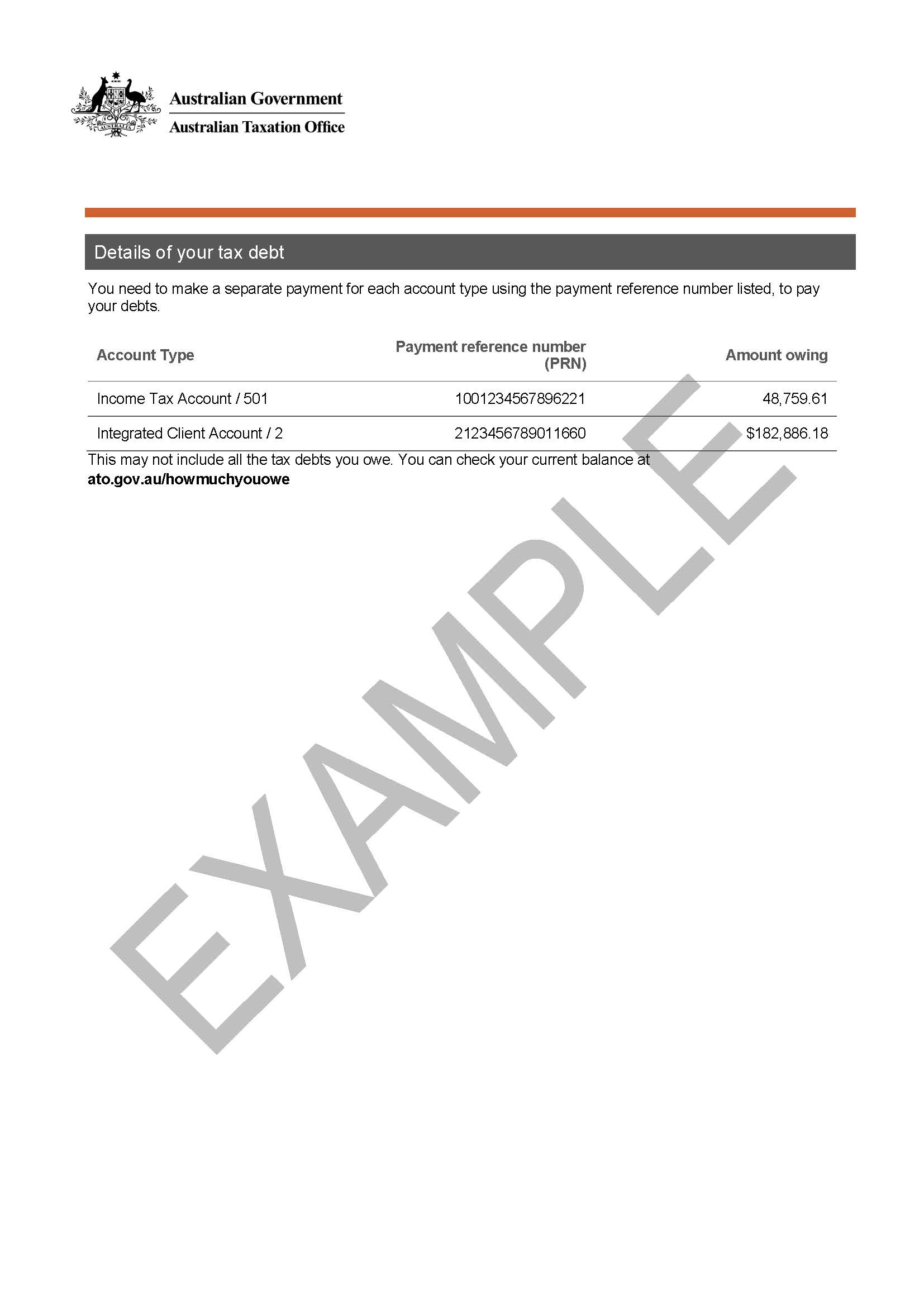

An entity is within the class of entities whose tax debt information may be reported if the entity is carrying on a business with an ABN and has a tax debt of which at least $100,000 is overdue for more than 90 days and has failed to actively manage the debt (i.e., by entering into a repayment plan).

Once the ATO determines that they will report the debt, the Commissioner:

- Will provide at least 21 days’ notice in writing to the taxpayer of their intention to disclose the debt to a CRB.

- Has to consult with the Inspector-General of Taxation prior to disclosing the debt. This is intended as a safeguard to ensure information is not disclosed inappropriately.

After the initial disclosure of a taxpayer’s information, the ATO may make further disclosure of the taxpayer’s tax debt information, i.e., routinely update the CRB of the amount owing.

Once the taxpayer no longer falls within the class of entities whose tax debt information can be disclosed and is removed, any subsequent disclosure must be treated as an initial disclosure.

How do I avoid credit reporting disclosure?

The ways in which to avoid having a company’s tax debts reported to a CRB include:

- Where a taxpayer is effectively engaging with the ATO to manage their tax debt by undertaking specific actions, for example, has entered into a repayment plan; or

- Where the Inspector-General of Taxation has advised the Commissioner that the Inspector-General of Taxation has an active complaint relating to the taxpayer’s tax debt or the disclosure of the taxpayer’s tax debt information; or

- Where a taxpayer is disputing the calculation of tax debt through the Administrative Appeals Tribunal or the courts.

The Commissioner will also have discretion regarding whether or not to disclose the tax debt information outside the legislative framework. This includes exceptional in exceptional circumstances such as impacts of natural disasters, illness or other family tragedies.

Resources

Further Australian Taxation Office (ATO) resources

Information on Disclosure of business tax debts -

https://www.ato.gov.au/General/Paying-the-ATO/If-you-don-t-pay/Disclosure-of-business-tax-debts/

Inspector-General of Taxation Tax Ombudsman information on how to lodge your ATO credit reporting complaint -

https://www.igt.gov.au/make-a-complaint/how-to-lodge-your-dbtd-with-us/

Taxation Administration (Tax Debt Information Disclosure) Declaration 2019 -

https://www.legislation.gov.au/Details/F2019L01687

Treasury Laws Amendment (2019 Tax Integrity and Other Measures No. 1) Act 2019 – Disclosure of business tax debts -

https://www.ato.gov.au/law/#Law/table-of-contents?LocID=%22PAC%2F20190095%22

PS LA 2011/3 – Compromise of undisputed tax related liabilities and other amounts payable to the Commissioner -

https://www.ato.gov.au/law/view/document?docid=PSR/PS20113/NAT/ATO/00001

PS LA 2011/4 - Collection and recovery of disputed debts -

https://www.ato.gov.au/law/view/document?docid=PSR/PS20114/NAT/ATO/00001

PS LA 2011/5 - Recovery of administrative overpayments -

https://www.ato.gov.au/law/view/document?docid=PSR/PS20115/NAT/ATO/00001

PS LA 2006/7 - Alternative assessments -

https://www.ato.gov.au/law/view/document?docid=PSR/PS20067/NAT/ATO/00001

PS LA 2011/7 - Settlement of debt litigation proceedings -

https://www.ato.gov.au/law/view/document?docid=PSR/PS20117/NAT/ATO/00001

PS LA 2011/14 - General debt collection powers and principles -

https://www.ato.gov.au/law/view/document?docid=PSR/PS201114/NAT/ATO/00001

PS LA 2011/16 - Insolvency - collection, recovery and enforcement issues for entities under external administration -

https://www.ato.gov.au/law/view/document?docid=PSR/PS201116/NAT/ATO/00001

PS LA 2011/17 - Debt relief, waiver and non-pursuit -

https://www.ato.gov.au/law/view/document?docid=PSR/PS201117/NAT/ATO/00001

PS LA 2011/18 - Enforcement measures used for collection and recovery of tax-related liabilities -

https://www.ato.gov.au/law/view/document?docid=PSR/PS201118/NAT/ATO/00001

PS LA 2011/21 - Offsetting of refunds and credits against taxation and other debts -

https://www.ato.gov.au/law/view/document?docid=PSR/PS201121/NAT/ATO/00001

Further Shaw Gidley Articles on Australian Taxation Office (ATO) recovery proceedings

AUSTRALIAN TAXATION OFFICE DIRECTOR PENALTY NOTICE -

https://shawgidley.com.au/blogs/director-penalty-notices

AUSTRALIAN TAXATION OFFICE (ATO) WINDING UP PROCEEDINGS -

https://shawgidley.com.au/blogs/australian-taxation-office-ato-winding-proceedings

AUSTRALIAN TAXATION OFFICE (ATO) PAYMENT PLAN / ARRANGEMENT -

https://shawgidley.com.au/blogs/australian-taxation-office-ato-payment-plan-payment-arrangement

AUSTRALIAN TAXATION OFFICE GARNISHEE NOTICES -

|

|

|

Shaw Gidley are experts in restructuring, turnaround and insolvency.

We provide free initial advice on these matters.

Please contact our offices on (02) 4908 4444 or (02) 6580 0400.