This article explains how much a liquidation costs. While cost is an important consideration, the liquidation process can be stressful. As such, it is important to select a firm that can finalise the liquidation process efficiently and effectively and ensure the process is compliant and your worry and stress are behind you. Shaw Gidley can achieve this for you.

Whether you are looking to appoint a bankruptcy trustee, administrator, liquidator, or receiver, Shaw Gidley has the experts and market-leading processes that allow us to deliver insolvency services to solve your personal, business or company financial problems.

For a free initial consultation and a quote please contact our offices on (02) 4908 4444 or (02) 6580 0400.

Costs of a liquidation

How much does a liquidation cost?

Depending on the type, size, and complexity of a liquidation, the cost may vary between $4,000 to $6,000 for a simple member’s voluntary liquidation (for solvent companies) to $10,000 to $15,000 for a simple creditor’s voluntary liquidation (insolvent companies).

Given that each corporate liquidation will be different, the actual cost can vary significantly. Cost savings are achieved by ensuring the process is performed in an efficient and effective manner by experienced experts undertaking market-leading processes and procedures as is the case with Shaw Gidley. Fixed price liquidations are also available in certain circumstances.

As a guide, with creditor's voluntary liquidations, Shaw Gidley estimates the following cost brackets:

| Description

|

Estimated Cost

|

| Simple Liquidation – Sole shareholder/director, less than 10 creditors, no assets, no disputes and no recoveries, no corporate regulator involvement

|

$10,000 - $15,000

|

| Low complexity liquidation - More than 10 creditors, easily realisable assets, straightforward recoveries, minor disputes, no employees, no corporate regulator involvement

|

$15,000 - $50,000

|

| High complexity liquidation - numerous creditors including employees, multiple asset categories, secured creditor involvement, recoveries, complex disputes, corporate regulator involvement

|

$50,00+

|

Can a liquidation be free?

If sufficient assets are available in the Company, yes, the costs of the liquidation are free for the directors.

In reality there is always a cost to conduct a liquidation. Believe it or not, quite often, due to a liquidator’s statutory obligations, where there are insufficient funds to pay for a liquidation, the liquidator’s firm wears those costs in the form of unrecovered time charged.

In cases where assets and/or recoveries are available in the company, the proceeds from the sale of those assets are used to pay for the costs of the liquidation and if sufficient, dividends to creditors. In some cases, liquidators may also be able to recover payments made to certain creditors, such as the ATO, within the 6 months preceding the liquidation date (also known as preference payments) to cover some or all of the liquidation costs. In those cases, there may be no upfront cost to the director personally in appointing a liquidator.

If there are no assets available in the Company - a liquidator may ask a director to contribute funds to pay for the cost of the liquidation. At Shaw Gidley, we will cap the amount directors need to contribute towards the cost to wind up your company so that your liability in this regard is known. This may differ from the overall cost to wind up the company however.

We estimate that the average liquidation cost will be between $10,000 to $15,000 and be completed in 6 to 12 months. As a rough guide, we have summarised some of the costs of a creditor’s voluntary liquidation based on our experience. As discussed, where assets are available to pay for the below costs, the director does not have to make any contributions.

| Description | Estimated Cost

|

| Simple Liquidation – Sole shareholder/director, less than 10 creditors, no assets, no disputes and no recoveries, no corporate regulator involvement | $10,000 - $15,000 |

| Low complexity liquidation - More than 10 creditors, easily realisable assets, straightforward recoveries, minor disputes, no employees, no corporate regulator involvement | $15,000 - $50,000 |

| High complexity liquidation - numerous creditors including employees, multiple asset categories, secured creditor involvement, recoveries, complex disputes, corporate regulator involvement | $50,000+ |

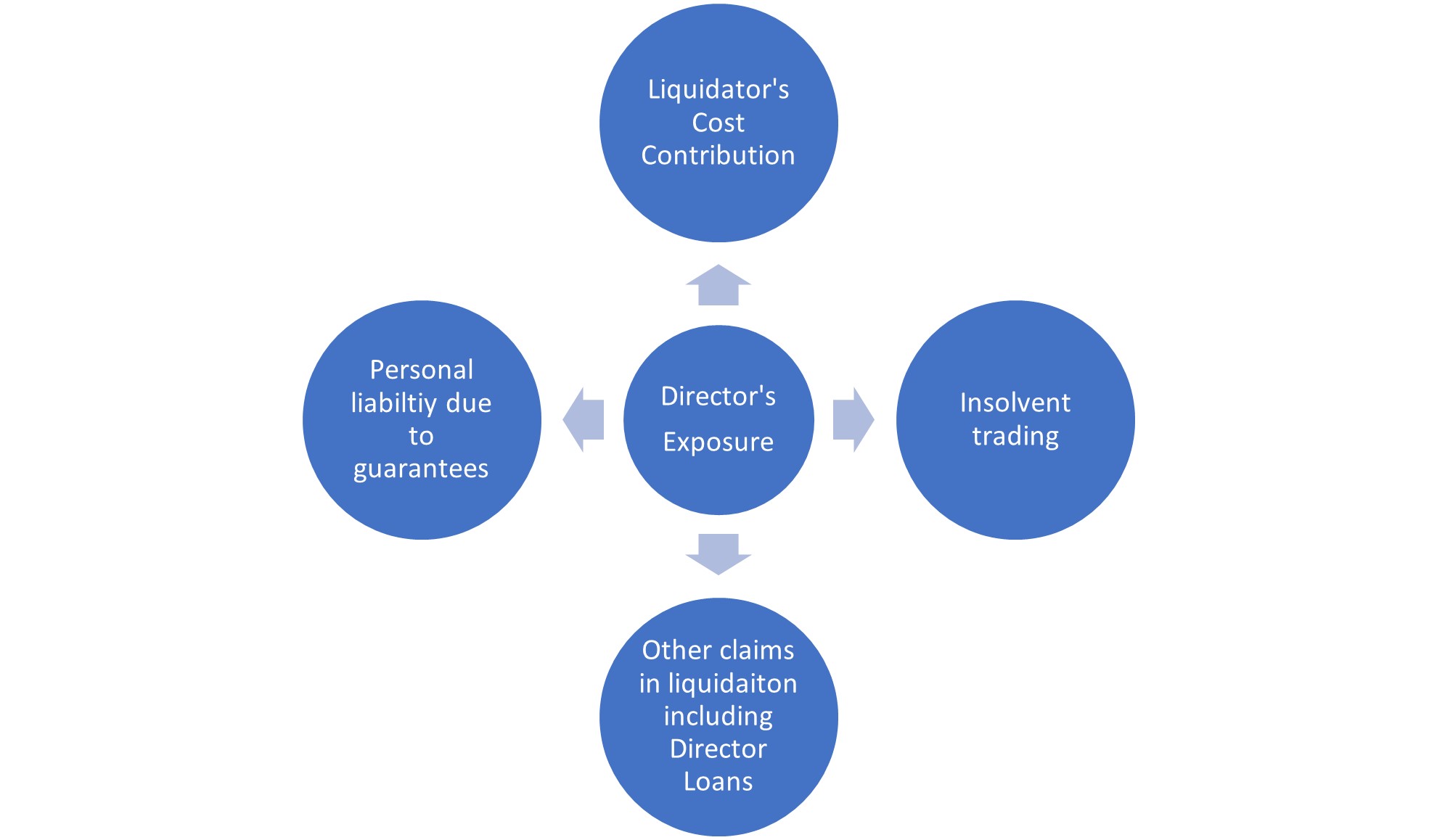

Directors should be aware however of other areas of exposure when liquidating a company other than contributing towards the cost of its liquidation. A liquidator is legally obligated to investigate some of these areas of exposure or pursue amounts owing by the director to the company. The schematic below attempts to summarise some of the areas of exposure for a director of a company.

Cheapest Liquidation in Australia

A word of warning – beware of firms offering a “free liquidation” or “the cheapest liquidation in Australia” because nothing in life is free and likely there are some hidden costs involved in the process that are not disclosed to you.

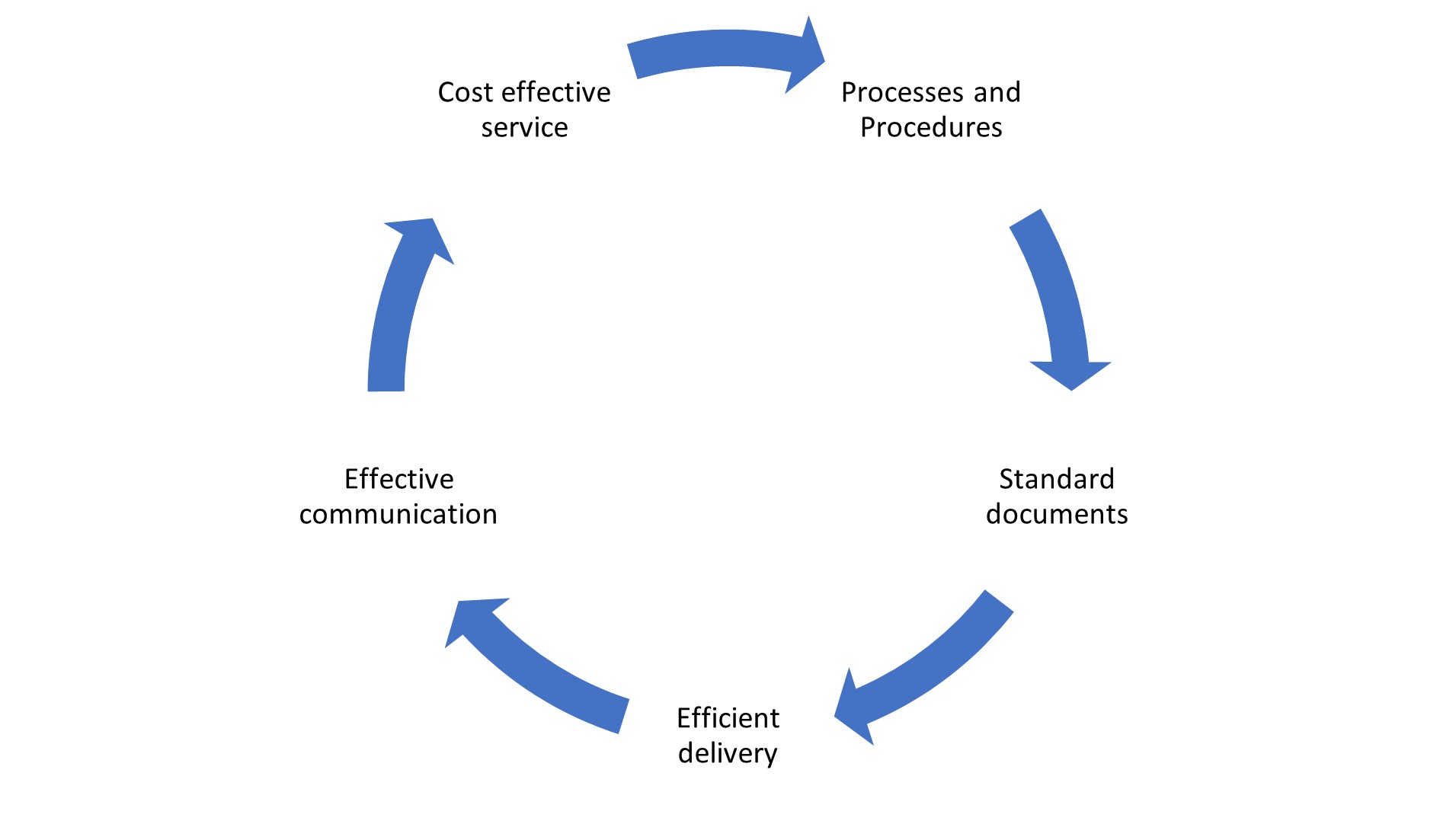

Generally, we have found that liquidators across Australia charge very similar hourly rates for the work they undertake. The key difference in cost mainly relates to the efficiency that a firm can achieve in turning around a corporate matter from start to finish which is a by-product of a firm having experienced, qualified professionals and effective processes and systems as is the case at Shaw Gidley.

Shaw Gidley’s Conceptual framework (outlined below) results in our firm providing market leading quality insolvency services with an emphasis on efficiency and effective communication.

Beware of unregistered advisers offering you the cheapest liquidation

Unfortunately, there are a lot of unregulated pre-insolvency advisers alleging to offer “free liquidations” or the “cheapest liquidation” in Australia.

In our experience, these advisers quote a certain amount to “bring in” a matter, with the final cost ultimately exceeding the estimate, as they do not include the true costs of entering into liquidation as you do not get the full story.

The pre-insolvency advisers fee can sometimes amount to tens of thousands of dollars, without actually adding any value to the winding up process and leaving directors out of pocket. Shaw Gidley has had examples where directors have been charged several thousand dollars for advice from a pre-insolvency adviser that Shaw Gidley would have provided without charge and obligation free in our initial consultation.

We pride ourselves in providing you with full transparency of the likely cost associated with your matter and encourage you to contact our office on (02) 4908 4444 should you wish to discuss any quotes you may have received.

It may be that we advise you that in our opinion the actual cost may be significantly higher than you have been quoted allowing you to make a more informed decision about your choice of liquidator. Just remember the old saying “If it’s too good to be true, it probably is” applying to liquidation costs.

In the past, we have seen unscrupulous pre-insolvency advisers and liquidators making various promises about the costs and outcomes of liquidations. Usually, these advisers may:

- Advise directors against appointing a liquidator immediately and suggest that they instead be engaged to set up or facilitate a business restructuring. Usually, pre-insolvency advisers will market themselves as “director advocates”.

- Use scare tactics with directors already under significant pressure to get them to sign on the dotted line by saying such things as “if you don’t you may go to goal”.

- Suggest that the director appoint their liquidator who is familiar to them and will not pursue the director for any debts or cause any problems.

- Provide advice on how to shift or transfer assets to a new company, effectively illegally phoenixing the business of the company. This advice can often lead to more problems and costs to the director.

- Suggest that they can undertake the liquidation for a lower fee than approaching a registered liquidator.

While liquidators have to adhere to a strict code of professional standards, pre-insolvency advisers are not subject to any professional code of conduct or oversight by regulatory bodies or government bodies such as the Australian Securities and Investments Commission (“ASIC”). The educational and experience requirements for admission as a registered Liquidator are extremely high and liquidators need to renew their licenses with ASIC periodically. In comparison, there is no set qualification required to become a pre-insolvency adviser. This has resulted in unscrupulous advisers in the industry.

Further still Australian Financial Security Authority (AFSA), ASIC and ATO are cracking down on dodgy advice from pre-insolvency advisers.

Our experience suggests that some pre-insolvency advisers will tailor their advice to benefit themselves and not directors, creditors, or the company. As an example, in the past, we have come across the following conduct by pre-insolvency advisers:

- Directors initially being promised a cheap liquidation for a small fee. Usually, the pre-insolvency adviser offers to help facilitate a phoenix of the business or a transfer of assets. The director usually ends up paying a substantially larger fee for the pre-insolvency advice.

- Directors paying large sums of money to the pre-insolvency adviser and not receiving any meaningful or proper advice.

- Directors paying large fees for verbal advice - the pre-insolvency advisers will say that they are unable to put their advice in writing and only provide verbal advice. If this advice proves incorrect a director may have no recourse against the pre-insolvency adviser.

- Directors being pursued by liquidators for transferring assets pre-appointment for little to no consideration or phoenixing the company’s business. Usually, in these circumstances, the director has already paid a substantial amount to the pre-insolvency adviser to provide advice on how to effectively transfer assets, only to then find out that the transfer was illegal and the assets recoverable by the liquidator. The directors could have achieved a better and cheaper result by dealing directly with the liquidator.

- In one matter the director paid approximately $200,000 to a pre-insolvency adviser believing that the adviser was settling a claim in the liquidation only to later find out that the adviser (and money) had disappeared. Ultimately due to the bad advice the director had to pay another $300,000 to the liquidator to settle various claims and was subject to detailed scrutiny by the Corporate Regulator and the Supreme Court of New South Wales.

- Because the directors act upon incorrect pre-insolvency advice, they are prosecuted by ASIC for either civil or criminal offences.

Accordingly, we suggest directors avoid dealing with pre-insolvency advisers and question any advice or promises being provided about the outcomes of liquidations.

We recommend that you deal only with an experienced, qualified insolvency practitioner who is a member of an appropriate professional body, such as Shaw Gidley.

Shaw Gidley will provide directors with the right advice which will not breach the laws. This advice is often provided free in our initial consultation. Often our referrers who are accountants and solicitors, contact our office, telling us that their client has received advice from a pre-insolvency adviser which we immediately determined as being not in the best interest of the company, its creditors and the director.

Liquidator Fees – time-based charging (hourly rate), fixed cost, or contingency?

There are generally three (3) methods that liquidators use when charging fees:

- Time based;

- Fixed fee; or

- Contingency/percentage of the recovery.

In a creditor’s voluntary liquidation (insolvent company) creditors approve the liquidator’s remuneration. In a member’s voluntary liquidation (solvent company) the remuneration is approved by the members.

Accordingly, while a liquidator may negotiate how the costs of the liquidation will be paid, it will be either the creditors or members who will vote on the liquidator’s remuneration. If the creditors do not agree to approve the liquidator’s costs, the liquidator may also approach the court and seek to have their costs assessed.

Fixed price or percentage based liquidation costs

Fixed price liquidations are not a common practice for creditor’s voluntary liquidations (insolvent) but are available for members voluntary liquidations (solvent). Please contact Shaw Gidley if you wish to discuss a fixed price liquidations.

Percentage based liquidation remuneration is very rare as its often difficult to predict what is required to be completed in a liquidation, as often not all information is known and liquidators are unable to control third party responses to the liquidator’s appointment.

Time-based charging

Time-based charging represents the most common and widely used method of liquidator remuneration. The advantage of time-based charging is that a liquidator gets paid for the actual amount of work they undertake and best reflects the true value of work completed.

Creditors can control a liquidator’s fees as they have the power to review and approve the fees at meetings of creditors. If the liquidation is completed for less than the amount approved, that is all that will be charged. If it costs more, a liquidator may go back to creditors seeking further approval for the remaining amount if assets are available in the company to allow for this. If creditors reject the liquidators fee proposal the liquidator can go to court to have their fees approved.

The reason why time-based charging appears to be the most popular and widely used method is that it directly reflects the underlying cost to the firm of completing the work that is required. It also means that liquidators are only rewarded for the work that is completed.

Liquidators charge rates?

Liquidations are very complex affairs. Upon appointment, liquidators interact with a plethora of legal, accounting, financial, social, economic, regulatory and political issues. Be it tax law or tort law, unions or industry groups, employees or employers, debtors or creditors, media and local politicians, budgets and bankers, the list goes on. You name it, it can play a role in a liquidation. Each one of these external forces will have its own agenda and often conflicting interests and expectations of the liquidator’s statutory role and commercial objectives.

Liquidators’ charge rates are a function of several matters, including:

- The level of training and experience required to become a registered liquidator is no different from what is required to become a partner at a mid-tier or top-tier commercial law firm. In this respect, the charge-out rates of insolvency firms somewhat reflect the current market rate of a commercial law firm.

- Market forces dictate what an appropriate charge our rate is. In our experience, all mid-tier firms have similar charge-out rates for their staff. While some small micro (one-man band) firms have lower charge-out rates for their senior staff, those staff usually also undertake tasks that are typically completed by more junior staff at bigger firms. The courts have regularly reviewed the appropriateness of liquidator remuneration and charge out rates validating the current hourly rate cost.

- The underlying cost and expenses of running an insolvency practice are very unique to an insolvency business. Liquidators are required by Law to undertake certain statutory tasks and investigations even in circumstances where they do not have any funding available. So, imagine having to conduct certain investigations or reporting to ASIC, ATO, and creditors without any recourse to funding! This adds further hidden overhead costs to running an insolvency practice.

- Liquidators are subject to a significant level of regulation by government bodies, the courts and professional bodies requiring complex systems of quality control in completing tasks which often includes activities which do not add commercial value to the liquidation process.

- Other general business expenses including significant wage costs, professional membership fees, training, recruitment, marketing, human resources, etc… similar to any other business.

Some of the criticism levied towards time-based charging is however well founded. Unmonitored, time-based charging may result in inefficiency being rewarded. Our firm has developed a practice of regularly reviewing time cost records (WIP integrity review) and appropriately considering the work that has been completed including considering matters such as whether:

- The work was necessary

- Ensure the work undertaken and time spent was appropriate

- Whether the appropriate staff member has undertaken the work (including whether the staff member is appropriately trained and qualified or if the work could have been conducted by a more junior staff member)

- Why the work was performed in the first place and whether it was required to be undertaken.

Where appropriate, our time costs are adjusted appropriately to ensure creditors are not being charged for unnecessary work. We call this a WIP integrity review.

In addition, we regularly conduct workflow meetings and planning meetings with junior staff to ensure that only work necessary for the completion of the administration is completed. We also regularly undertake training on time and priority management of our staff to ensure that we maintain our reputation for being “doers” in the marketplace.

Is appointing a local liquidator cheaper?

Our office staff and offices are located in Central Coast, Newcastle, Hunter Valley and Port Macquarie. Not all liquidations require the liquidator to attend your office. Liquidations can be done remotely or online. We regularly engage agents to undertake tasks such as inspecting company premises and valuing plant and equipment, collecting books and records off-site, or backing up externally prepared financial statements. This allows us to service clients Australia-wide.

We live in digital world now and working remotely is common practice. Most company records are now held digitally, further reducing costs. If for some reason we are required to travel interstate to locations where we do not have an office to conduct any work, we will ordinarily not charge for the travel time and cost. Accordingly, there is an option to appoint a liquidator from our firm wherever you are in Australia.

If however, we believe that you may be better serviced by a local liquidator we can provide you with some recommendations of reputable, cost-effective practitioners in your local state.

Why is liquidation so expensive?

Some stakeholders may ask us why is a liquidation so expensive? Many matters may impact the cost of a liquidation. Most standard liquidations which only have 1 creditor such as the ATO and no assets can be completed for $10,000 to $15,000 whereas other larger more complex matters will incur further costs.

The below is an attempt to summarise some of the issues that may impact the price of the liquidation and generally the factors that a liquidator should consider when providing a director with a cost estimate about a liquidation. Often these are factors which we cannot control but stakeholders expect us to deal with or may be required to be attended to for statutory reasons:

- Asset realisation-related costs including the sale of plant and equipment, business, real property, stock, and other assets both tangible and intangible. The type of asset required to be sold may significantly impact the cost of the liquidation. For example, the process of selling a commercial factory can be a time-consuming and expensive exercise versus selling a motor vehicle.

- Dealing with landlords or other secured creditors who may hold security over company stock, motor vehicles, plant and equipment, real property, debtors, or other intellectual property.

- Reporting or liaising with all creditors. Under the legislation, creditors have statutory rights to demand reports from the liquidator outside the normal reporting cycle.

- Costs of preparing statutory reports to creditors (these vary largely depending on the complexity of the matter.

- Statutory reporting to the ASIC. ASIC sometimes requires further supplementary reports to be prepared in certain matters, further increasing the cost.

- Organise and maintain appropriate insurance where the business has assets or the liquidator is continuing to trade the business or occupy and use certain assets such as real property.

- Dealings with creditor enquiries throughout the liquidation.

- Dealing with conflicts between stakeholders

- Dealing with employee enquiries including quantifying any unpaid employee entitlements and corresponding with employees about their unpaid entitlements. This may include quantifying unpaid superannuation liabilities.

- Employee worker’s compensation claims and liaising with other government bodies including Centrelink and child support.

- Liquidators are required to secure all of a company’s physical and digital books and records and conduct various investigations into the company’s financial affairs. This will include tasks such as reviewing bank statements, asset registers, management accounting entries, undertaking statutory searches of related companies and parties such as directors, preparing various detailed file notes and working papers in support of any investigations undertaken, and in certain instances requesting directors and third parties to provide further details. The cost of undertaking these investigations depends on the size and complexity of the company’s corporate affairs as well as the state of the company’s books and records.

- In certain instances, the liquidator may identify various transactions which can be recovered for the benefit of creditors such as preference payments, unreasonable director-related transactions, or other voidable claims that the liquidator is required to identify and report on to creditors. As well as this, the liquidator is required to investigate if the company was trading whilst insolvent, whether a claim exists against the company’s director and whether it would be commercial to pursue any such claim.

- Liquidators may pursue litigation or court action. Alternatively, creditors may fund litigation or other legal proceedings, thus resulting in significant costs and expenses.

- Administrative costs are incurred in the liquidation due to ongoing requirements to lodge statutory forms and documents with ASIC and the ATO as well as the cost of general administrative work such as maintaining the bank account and other matters. Therefore matters that are ongoing for an extended amount of time will by their very nature incur more costs.

If a liquidator is required to trade on a business for any period, costs can be significantly higher. This may occur in circumstances such as when the business may be offered for sale or certain projects are required to be completed. In those circumstances, a liquidator will need to continue employing staff or subcontractors and supervise and manage the trading.

- After all of the assets have been realised and ASIC has provided the liquidator with clearance to finalise the matter, the liquidator will be required to lodge various forms with ASIC and the ATO and continue to store or apply to destroy books and records of the company.

- If assets are available to be distributed to creditors, a formal dividend process has to be followed. This does not simply allow funds to be paid to creditors. Creditors are required to formally prove their debt in the liquidation and provide certain forms and information, further adding to the cost of the liquidation.

As previously disclosed, we have summarised some of the costs of a creditor’s voluntary liquidation based on our experience:

| Description

|

Estimated Cost |

| Simple Liquidation – Sole shareholder/director, less than 10 creditors, no assets, no disputes and no recoveries, no corporate regulator involvement

|

$10,000 - $15,000

|

| Low complexity liquidation – More than 10 creditors, easily realisable assets, straightforward recoveries, minor disputes, no employees, no corporate regulator involvement

|

$15,000 - $50,000

|

| High complexity liquidation - numerous creditors including employees, multiple asset categories, secured creditor involvement, recoveries, complex disputes, corporate regulator involvement | $50,000+

|

As mentioned, it is very difficult to provide an estimate without discussing the specific circumstances of a company. Accordingly, we encourage you to contact our office to discuss your circumstances, so we can provide you with an estimate of fees.

Creditors Voluntary Liquidation

A creditors voluntary liquidation, or CVL, is the process of winding up a company that is no longer able to pay its debts as and when they are due.

Why would I appoint a liquidator to close down my company?

A liquidation facilitates a fair and equitable distribution of the company’s resources and ultimately results in the company being deregistered.

If your company is not placed into liquidation and deregistered:

- ATO can issue a director penalty notice (DPN) making you personally liable for company debts.

- Creditors may continue enforcement proceedings against the company which may require you personally, as director, to deal with.

- Debt collection agencies may continue to contact you.

- Interest will continue to accrue on certain liabilities. Some of these liabilities may be personal liabilities of the director without the director even realising (for example for personal guarantees provided or due to unreported or late ATO lodgements). The director may ultimately be pursued for these amounts.

- Your credit rating may be impacted because you are a director of a company that has various debts. Once the company is liquidated and deregistered it may become easier to secure personal finance

- If you start a new company suppliers may be hesitant to deal with you given your current registered company has outstanding debts and a bad credit rating.

- If you continue to trade the company while it is insolvent, you may become personally liable for any debts incurred.

How do I liquidate my company myself and close it down?

A director can’t undertake the liquidation and deregistration of their company. ASIC does not allow a company to be deregistered if it has assets or liabilities or is insolvent. If you believe your company is insolvent, you should seek professional advice immediately, otherwise, if you continue to trade you may be personally liable for insolvent trading.

Does the liquidation stop creditors chasing directors?

Another matter directors may not consider is whether liquidating a company will stop the debt collection process. There are a large number of instances where directors may have become personally liable for company debts, these may include instances where the director is not even aware that they may be personally liable for those debts. In those cases, the liquidation may not resolve the director’s exposure as the director will need to pay back those funds personally.

For example, in certain instances, directors can become liable for unpaid and/or unreported liabilities such as superannuation or ATO debts including PAYG, GST, wine equalisation tax, or luxury car tax. Other common personal liabilities could be a result of liabilities due to personal guarantees provided to trade creditors and suppliers.

Members Voluntary Liquidation

A member’s voluntary liquidation, or MVL, is the process of winding up a solvent company, being a company that can discharge all of its debts within 12 months.

Why would you pay someone to undertake a members voluntary liquidation?

MVL can provide directors or shareholders with several benefits including the ability to access any capital gains or realise tax concessions before finalising their financial obligations and closing the company.

Company directors or shareholders often decide to dissolve their company when they no longer require it for reasons including:

- If a company is not operating

- All tax losses have been fully utilised

- The desire to distribute capital gains, or

- To restructure the company’s holding balance sheet.

Sometimes a MVL is used when shareholders are in dispute and wish to go their own separate ways.

How much does a Members Voluntary Liquidation cost?

Basic MVL (known as a cashbox MVL) can cost between $4,000 to $6,000. As the word “cashbox” suggests, the liquidator is simply paying out cash at bank which is reflected in retained profits and reserves. In addition all ATO and other statutory body lodgements and tax payments are up to date, allowing for the liquidator to simply distribute funds to members

What can make a Members Voluntary Liquidation more expensive?

Some of the factors which could make an MVL more expensive include:

- Realising assets that have not yet been sold, i.e. plant and equipment, real property, and the like.

- Disputes amongst shareholders about distributions and other matters

- Outstanding tax lodgements

- Assets still registered with the company such as motor vehicles

- Insurance claims arising during the liquidation

- If there are unpaid creditors, enquiries dealing with those creditors

- Employee entitlements left unpaid

- Books and records that are required to be maintained by law are left with the liquidator to deal with.

- Litigation that arises during the MVL

- Inadequate financial statements and records requiring reconciliation in order to access tax concessions and identify pre and post-CGT assets

- Complexities associated with dealing with companies that act as corporate trustees of trusts

- Issues associated with closing bank accounts and dealing with certain financial institutions

- Financial statements that have not been updated and require the liquidator to undertake reconciliation

- Unreconciled statutory registers

To minimise liquidator expenses being incurred, our staff will engage with the director and accountant before our appointment to check that you have considered all of the above matters (and others) before the liquidator’s appointment. At Shaw Gidley we undertake a detailed pre take up review so there are no surprises.

What happens if my MVL costs increase beyond the fixed price?

We prefer to complete the liquidation for the fixed price agreed. In certain instances, there may be factors outside of our control that result in our firm having to do work that we did not initially anticipate and this results in costs increasing.

As outlined above, ordinarily the reason may be difficulties dealing with third parties, gaining certain information, or matters that were not initially anticipated. In those instances, we will contact you and discuss the additional costs which will likely be incurred and ways to minimise our involvement and cost.

How do I appoint a liquidator and close down my company?

If you wish to appoint a liquidator, contact our office on (02) 4908 4444 so we can make an obligation and cost-free assessment of your circumstances. We will then prepare the necessary documents required to formalise our appointment and once executed, we will commence our appointment as Liquidator of the company.

The process is simple and requires you to complete several statutory documents. Our office can prepare the relevant forms and complete the liquidation. The liquidator will then undertake the liquidation and close down (deregister) the company on completion of the liquidation.

Resources

Further Shaw Gidley resources on appointing a liquidator

For a free initial consultation and a quote please contact our offices on (02) 4908 4444 or (02) 6580 0400.