With reference to my article in the March 2020 edition of Sharkwatch, it appears that the Government’s financial stimulus and moratoriums on bankruptcy and liquidation proceedings have effectively stalled the effects of the pandemic, however this is likely to change in the next 3 months.

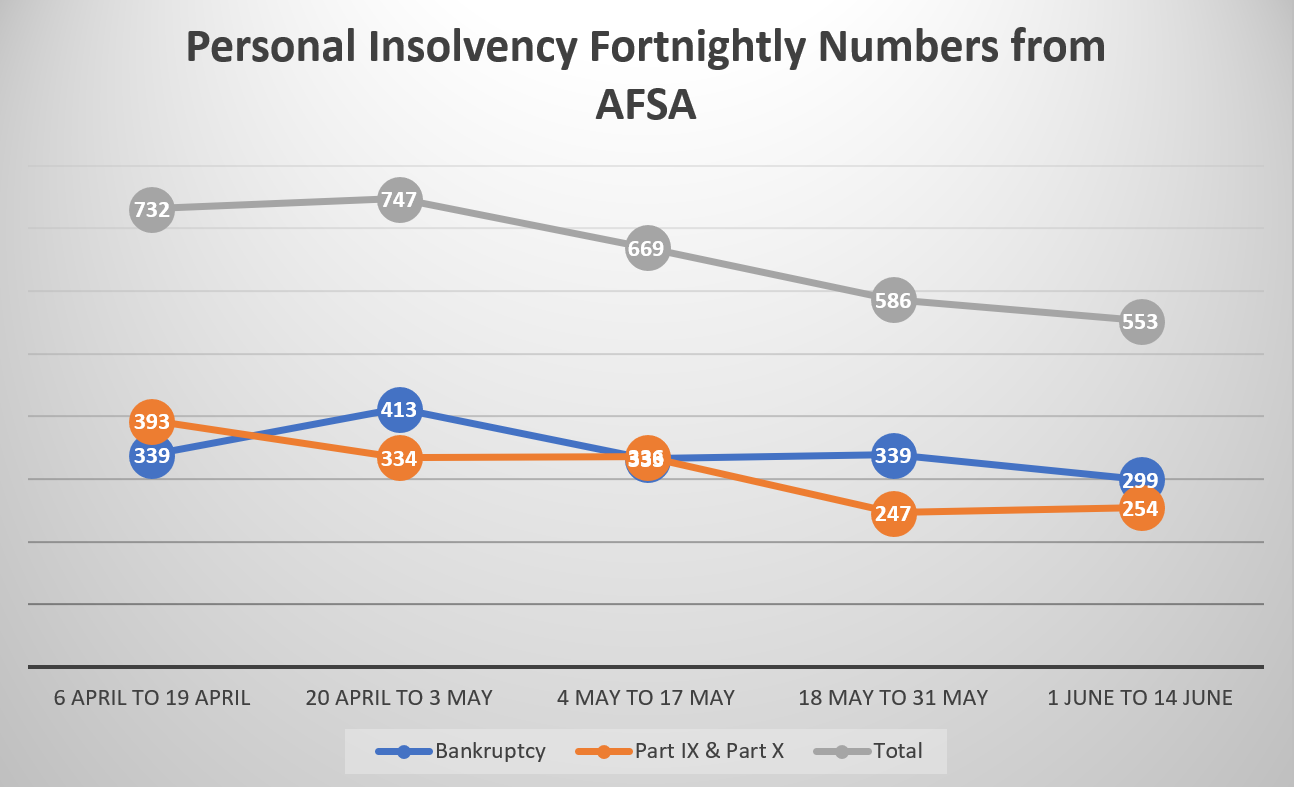

To demonstrate, the data released by AFSA of new formal personal insolvency arrangements entered per fortnight, the numbers are lower than previous months. To give perspective the average number of individuals who entered into formal insolvency arrangements between 1 July 2019 to 22 March 2020 was 884, as opposed to the most recent data of 553.

This implies that the measures taken by the Government have effectively flattened the financial distress curve, mitigating the immediate impact of COVID. However, most measures will expire late September 2020, and economists are predicting an “economic cliff” for businesses and households relying on the stimulus packages and incentives currently in place.

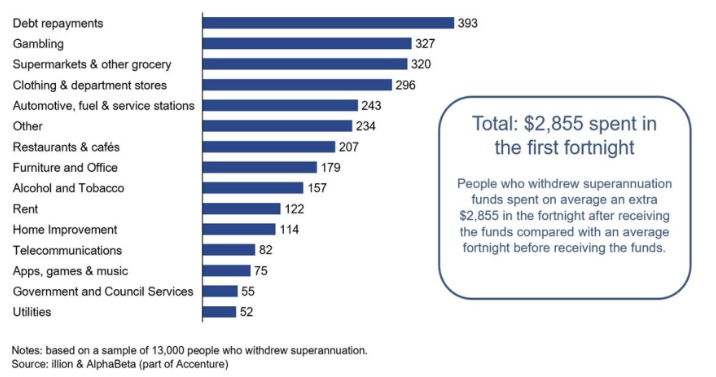

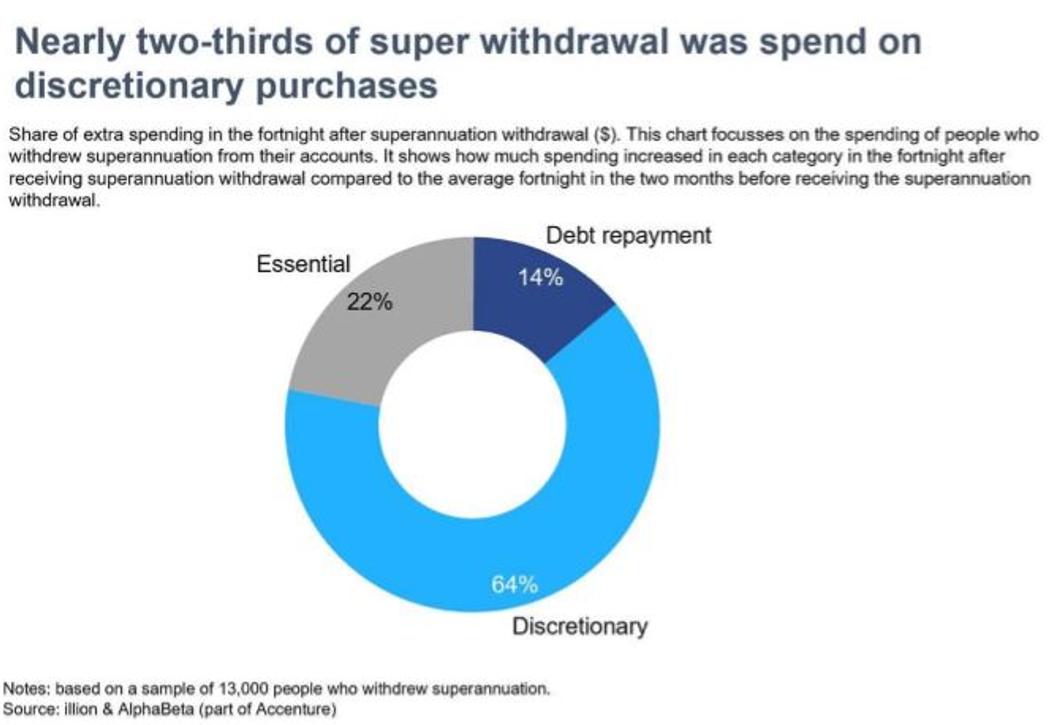

An indication of this occurring is found in the recent analysis completed illion and AlphaBeta (part of Accenture) reporting that individuals who received early release of their super have not used the funds as intended. The study has shown that two-thirds of individuals have spent their super on discretionary items such as clothing, furniture, vehicles and alcohol. While 14% was spent on debt repayments; more than 10% was spent gambling. This suggests people are using the additional funds opportunistically, rather than as the intended financial support to ease financial hardship.

Given the financial measures, incentives and packages provided to individuals and businesses currently, there is no incentive or pressure for them to enter into a formal personal insolvency arrangement. Not to mention the back log of insolvencies that would have occurred had the Government not put a moratorium on bankruptcy proceedings. When the measures are removed in September/October 2020, it is predicted that the number of individuals and business seeking advice on their options will significantly increase.

As part of the continued support from myself and the staff at Shaw Gidley the below are links to recent articles which may assist when discussing options with clients: -

- Apply for early release of superannuation due to COVID-19 – in the context of bankruptcy

- Answers to how payments from COVID-19 Economic Response Package are treated in Bankruptcy

- 6 things you can do for your mental health when facing financial distress – released by ARITA

- Helping clients with companies in financial distress – released by ARITA, CAANZ and CPA

Shaw Gidley are experts in restructuring, turnaround and insolvency and provide free initial advice on these matters. Please contact our offices on (02) 4908 4444 or (02) 6580 0400.